In accounting, depreciation is a term used to describe any method of attributing the historical or purchase cost of an asset, across its useful life, roughly corresponding to normal wear and tear. It is of most use when dealing with assets of a short, fixed service life, and which is an example of applying the matching principle as per generally accepted accounting principles. Depreciation in accounting is often mistakenly seen as a basis for recognizing impairment of an asset, but unexpected changes in value, where seen as significant enough to account for, are handled through write-downs or similar techniques which adjust the book value of the asset to reflect its current value.

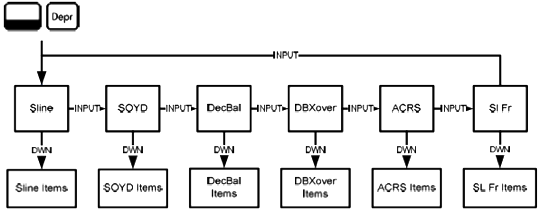

Press [Shift][Depn] to open the Depreciation menu. Press [INPUT] to cycle through the depreciation methods. With a depreciation method displayed, press [Arrow Up] or [Arrow Down] repeatedly to view the items of the sub-menu. To enter current data, key in a value and press [INPUT].

Depreciation Methods available on a HP 20b:

Sline - Straight line is a method of calculating depreciation presuming an asset loses a certain percentage of its value annually at an amount evenly distributed throughout its useful life.

SOYD - Sum-of-the-years’ digits is an accelerated depreciation method based on the idea that the years of an asset’s useful life are divided by the sum of the years counting backwards.

DecBal - Declining balance is an accelerated depreciation method that presumes an asset will lose the majority of its value during the first few years of its useful life.

DBXover - Declining balance crossover is an accelerated depreciation method that presumes an asset will lose the majority of its value in the first few years of its useful life, but that it will revert to a consistent depreciation during the latter part of its life, which is then calculated using the straight line method.

ACRS - Accelerated Cost Recovery System calculates the amount of tax deduction under U.S. Accelerated Cost Recovery System.

Sl Fr - Straight line French. This method of depreciation is similar to the Straight line method, except an actual calendar date in mm.dd format is entered in for Start= to indicate when the asset was first placed into service.

Depreciation Menu Items on a HP 20b:

Life= The expected useful life of the asset in whole years.

Start= Start refers to the date or month in which the asset is first placed into service. Depending on the type of depreciation, this can be the month, or the actual date in mm.dd format.

Cost= The depreciable cost of the asset at acquisition.

Salvage= The salvage value of the asset at the end of its useful life.

Year= Assigns the value of the year for which you want the depreciation.

Depreciation= Depreciation calculation used for straight line, SOYD, and declining balance methods only.

R.BookValue= Remaining book value.

R.DepreciableValue= Remaining depreciable value.

Factor= The declining balance factor as a percentage. This is used for declining balance and declining balance crossover methods only.