Cash flow is a term that refers to the amount of cash being received and spent by a business during a defined period of time, sometimes tied to a specific project. Measurement of cash flow can be used to evaluate the state or performance of a business or project. Cash flow can be used to validate the net income generated by accrual accounting.

On the HP 20b, a cash flow list is a set of numbered pairs, CF(n)and#CF(n), where n is the index of the cash flow list. Each pairrepresents a single cash flow. CF(n) represents the monetary value ofthe cash flow; CF(n) is the number of consecutive occurrences of that cash flow. By default, CF(n) is equal to 1, as most cash flows occur only once. However, in cases where a cash flow is repeated multiple times in a list, using CF(n) instead of entering thecash flow value multiple times can save you time and memory space inthe calculator.

Press [CshFl] key will open the cash flow list on HP 20b. Press [INPUT] will inputs current values to variables in the cash flow list as well as the Net Present Value (NPV) and Internal Rate of Return (IRR) menus.

Press [Up Arrow] or [Down Arrow] to scroll up and down.

[INS] to inserts cash flows into a cash flow list.

[DEL] to remove cash flows from a cash flow list.

Press [IRR] or [NPV] to open Internal Rate of Return (IRR) and Net Present Value (NPV) menus.

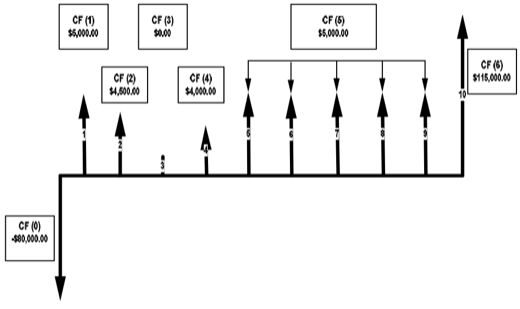

Typical Cash Flows Problem: After an initial investment of $80,000.00, you expect returns over the next five years as follows: cash flow 1 $5,000.00; cash flow 2 $4,500.00; cash flow 3, $0.00; cash flow 4 $4,000.00; cash flow 5 $5,000.00 for 5 times; cash flow 6 $115,000.00. Given this information, calculate the total of the cash flows and the internal rate of return ( IRR) of the investment. Calculate net present value ( NPV) and net future value (NFV), assuming an annual investment interest rate of 10.5%.

Using HP 20b ( in RPN Mode) to provide the above Cash Flows Solution in 2 parts.

Cash Flows Solution Part 1 - Data Entry:

- Press [CshFl] key to open the cash flow list starting with the current value of the initial cash flow, CF(0).

- Enter 80000 and press [+/-] [INPUT] to enter -80000 (sign of the cash outflow is negative) as the value of the initial cash flow. The screen will displays the current value, 1, for the frequency of CF(0).

- Press [INPUT] to input the current value of 1 for the frequency of CF(0). Displays the current value of CF(1).

- Enter 5000 and press [INPUT] [INPUT] as the value of CF(1).

- Enter 4500 and press [INPUT] [INPUT] as the value of CF(2).

- Enter 0 and press [INPUT] [INPUT] as the value of CF(3).

- Enter 4000 and press [INPUT] [INPUT] as the value of CF(4).

- Enter 5000 and press [INPUT] and key in 5 [INPUT] as the value of CF(5).

- Enter 115000 and press [INPUT] [INPUT] as the value of CF(6).

Cash Flows Solution Part 2 - Data Analysis:

- Press [NPV] key to open NPV menu starting with current value of Inv.I%.

- Enter 10.5 and press [INPUT] to enter value of 10.5 as current Inv. I%.

- Press [Down Arrow] key once to scroll to current value for NPV which is -14182.80.

- Press [Down Arrow] key once to scroll to current value for NFV which is -38493.26.

- Press [Down Arrow] key once to scroll to current value for Net US which is -2357.99.

- Press [Down Arrow] key once to scroll to current value for Payback which is 9.36.

- Press [Down Arrow] key twice to scroll to current value for Total which is 73500.00.

- Press [IRR] it returns current value for IRR which is 7.90.