HP 17bII+ Black-Scholes Example Program

The Black-Scholes equation estimates the value of a call or put option. One of the variables in this equation is the standard deviation of the rates of return on the stock. This number is not commonly available. However, the value may be estimated by using a source that publishes Beta statistics for a stock may also publish the standard deviation (or variance, which is the standard deviation squared) of the stock.

The equation store the following variables:

- Stock price per share in {PS}.

- Exercise price of option in {PE}.

- Periodic risk free rate of return as a percentage in {RF%}.

- Number of periods until expiration in {T}.

- Standard deviation, as a decimal, of the periodic returns of the stock in {S}.

Press CALLV to calculate the call option value per share of stock.

Press PUTV to calculate the put option value per share of stock.

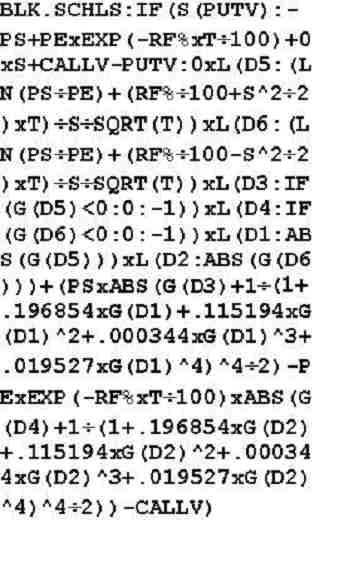

Enter the following Black-Scholes equation into the Solver. Enter every character shown, except for spaces. All spacing is for readability. Do not enter any spaces into the calculator.