A bond is simply a loan in the form of a security with different terminology: The issuer is equivalent to the borrower, the bond holder to the lender, and the coupon to the interest. Bonds enable the issuer to finance long-term investments with external funds.

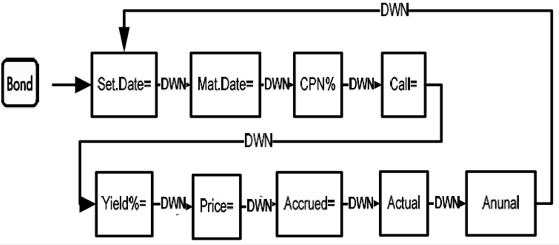

The Menu Map for the HP 20b Bond Menu.

SettlementDate= Settlement date. Displays the current settlement date in either mm.ddyyyy or dd.mmyyyy format.

MaturityDate= Maturity date or call date. The call date must coincide with a coupon date. Displays the current maturity date in either mm.ddyyyy or dd.mmyyyy format.

CPN%= Coupon rate stored as an annual %.

Call= Call value. Default is set for a call price per $100.00 face value. A bond at maturity has a call value of 100% of its face value.

Yield%= Yield% to maturity or yield% to call date for given price.

Price= Price per $100.00 face value for a given yield.

Accrued= Interest accrued from the last coupon or payment date until the settlement date for a given yield.

Actual/Cal.360 Actual (365-day calendar) or Cal.360 (30-day month/360-day year calendar).

Annual/Semiannual Bond coupon (payment) frequency.

HP 20b Bond Example

What price should you pay on April 28, 2010 for a 6.75% U.S. Treasury bond maturing on June 4, 2020, if you want a yield of 4.75%? Assume the bond is calculated on a semiannual coupon payment on an actual/actual basis. The example below is shown with RPN as the active operating mode.

Press [Bond] to open the Bond menu starting with the current ‘settlement date’. Inputs the current settlement date in mm.ddyyyy format. Enter 4.282008 and press [INPUT], the calculator will display 4 28 2008.